MTD - Interest Restriction Return (IRR) eReturns to HMRC

The Interest Restriction Return (IRR) is a filing required due to the Corporate Interest Restriction (CIR) legislation. It includes a summary of group details and calculates any interest restriction or reactivation. The return must be submitted within 12 months after the return period ends by a nominated reporting company on behalf of the group.

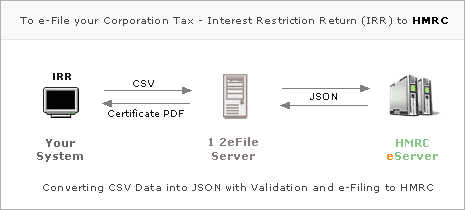

HMRC has introduced a new submission method for the Interest Restriction Return, utilizing the MTD platform. Now, companies or agents can directly submit returns to HMRC using MTD IRR-enabled software.

With 1 2eFile, you can conveniently submit either a full or abbreviated Corporation Tax - MTD Interest Restriction Return (IRR) for your company or group to HMRC.

The following four submission options are available:

- → Appoint a reporting company

- → Revoke a reporting company

- → Abbreviated interest restriction return

- → Full interest restriction return